04/07/22, Square and Afterpay

BNPL - ‘buy-now-pay-later’ or ‘big names, profit low’

Hello everyone, and welcome to week five of this newsletter.

First of all, sorry for that subtitle. It sucks, but so does this sector, as you will see.

I didn’t post on Friday - miss me? I was crushed by a tough day at the office + an unmissable performance of Hamilton on Thursday. I think for the next two weeks I’ll post only twice a week to ensure the quality is good - after my internship I’ll probably revert back to thrice a week.

Also, new structure alert!!! I’m going to do:

Deal outline;

Deal analysis.

Why? The deals I cover hardly ever have significant twists and turns, and the analysis is more useful than the timeline.

With that being said, let’s dive in!

Deal Outline

Sector: FinTech

Key info: Payments company Square buys BNPL provider Afterpay for $29b, representing a 30% premium on Afterpay’s share price prior to closing. In the announcement, Square say the acquisition delivers an ‘opportunity to drive growth across multiple strategic levers’

Enhance both the Seller and Cash App ecosystems;

Bring added value, differentiation, and scale to Afterpay;

Drive long-term growth with meaningful revenue synergy opportunities.

Company info:

Square (now called Block, but that name sucks) are your favourite tech company’s favourite tech company. Founded in 2009 by Jack Dorsey and Jim Mckelvey, Square mainly process digital payments between individuals (CashApp) and provide payment solutions for businesses (basically creates software that turns iPads into cash registers)

2021 shows $17b in revenue with a profit of $166m. Yep, that’s a tiny profit, but profit nonetheless - gold-dust for FinTech.

Afterpay was founded in 2014 by some Australians. It’s rare to see the Aussies create such a large company, but Afterpay, like Canva and Atlassian, has been a string of recent unicorns/decacorns to come out of the nation. These guys pioneer the buy-now-pay-later (BNPL) model - essentially credit cards with 0% interest. Instead, BNPL players make their money through fees from merchants. If I use Afterpay to finance a £50 Adidas top, Afterpay gives Adidas £50, minus a 4.19% processing fee. They also charge late fees if you mess up.

In 2018, Afterpay said 24% of their income was from late fees and 76% was from processing fees.

Here are a couple of useful slides for the Square investor presentation that sought to justify the Afterpay acquisition:

Advisors:

Square advised by Morgan Stanley (financial) and Wachtell and King & Wood Mallesons (legal)

Afterpay advised by Goldman Sachs and Qatalyst Partners (financial) and Cravath (legal)

Great line-up here - note Qatalyst, these guys are a little-known but extremely successful boutique that focus on tech M&A. Recent deals include Citrix being acquired by PE funds for 16.5b and Slack being acquired by Salesforce of $29b (god damn!!)

Deal analysis:

BNPL sounds like a cool idea right? We know people want to buy things on credit - US consumer credit stands at $841b currently So, when a Yank wants to finance their next Chevy Silverado purchase (do those things actually exist?), of course the ability to do so without paying interest is appealing.

However, the BNPL sector is slightlyyyyy screwed for three main reasons:

1: Product or feature?

The BNPL product is super simple, which means it is very replicable. Thus, when Apple recently announced that they will be offering their own BNPL service, competitors collectively soiled themselves. In the long-run, the question becomes this: can companies like industry leader Klarna justify their valuations, considering their entire business model can be copied and improved by other companies?

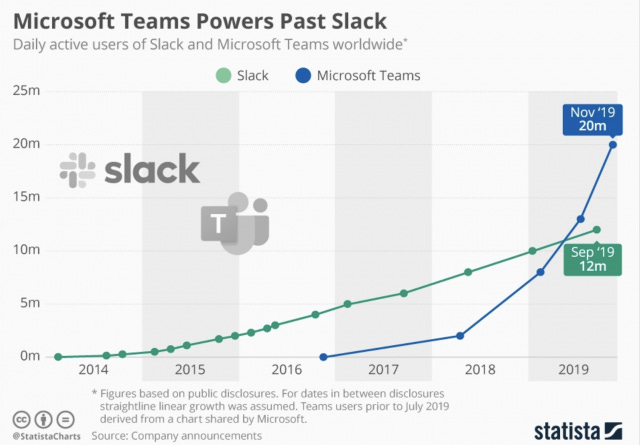

Look at this graph:

Slack enabled massive groupchats for companies. They had a huge head-start, before the monolith that is Microsoft implemented their own version: Teams. Within a few years, Teams had eclipsed Slack in every observable metric. What’s to stop the same thing happening to BNPL providers?

If you think about it, this process actually justifies Square’s acquisition. The payments industry is estimated by Square to be $10t, and they argue BNPL is at a 2% penetration rate. If Square can leverage its larger customer base to offer BNPL, then that’s a deathblow to incumbents like Klarna.

2: Macro factors

Look at this:

Klarna and Affirma are the two biggest BNPL providers - and they, alongside the whole BNPL industry, are getting obliterated right now. It works like this:

Macro climate takes a nosedive (pick any of the following: covid, Ukraine, oil, general supply chain issues);

Interest rates go up;

This increases cost/risk of borrowing;

People use BNPL less (even though there’s 0% interest, late fees accrue interest);

BNPL providers find it harder to raise money as people as less willing to lend;

BNPL providers see reduced revenues + fewer sources of financing;

Valuations drop… dramatically.

What I want you guys to take for this is that large, intangible events such as Covid have very real and very tangible aftereffects. Based on the sector, these aftereffects can be destructive (BNPL), accretive (healthcare), or irrelevant (gold).

BNPL has been uniquely screwed by recent events, so valuations have gone down immensely across the board. So, Square’s purchase suddenly seems very pricey, especially since they were paying a 30% premium to the share price.

3: Impending regulation

The quickest way to get a tech bro to drop their $18 latte and run away screaming is to whisper the word ‘regulation’ into their ears.

Regulating tech has generally been bad for companies in the short-run, but good for companies and consumers in the long-run. If a consumer knows the new tech they want to purchase is regulated, they feel more confident, and thus will be more likely to spend. Simple.

However, BNPL is at the cusp of immense scrutiny - the short-run is not looking good.

This is particularly clear in the UK, with the Government and FCA proposing to introduce rules regarding AML, KYC, credit checks and others as early as mid-2023 (lightspeed for government).

As Bloomberg Intelligence put it:

‘The double-whammy of consumers' inflationary squeeze and introduction of best practice will dramatically slow BNPL growth, with affordability checks and stricter financial promotion rules soon to incorporate BNPL.’

So, for companies like Apple and Square - tech behemoths with armies of lawyers - it’ll be annoying but manageable. For Klarna, Affirm and other pure-play BNPL providers, get ready for apocalypse.

However, don’t take my word for it. I spoke about this deal with an investment banker covering the sector, who said:

'So yes it’s easier for Square to buy Afterpay instead of building their own BNPL service, but that’s more because Afterpay has customer and tech than the regulatory paperwork in place’

Is regulation that much of an acquisition driver? Maybe not…

Key takeaway: the deal sounds clever in theory - Square’s existing network of sellers + buyers with Afterpay’s tech and BNPL market share. However, in light of macro developments and the vulnerability of the BNPL model, I can’t help but think Square overpaid for a business that essentially they could have built themselves.

Thank you for reading!

Hope you liked the new structure. It allows me to integrate more sources of information and maintain a smoother writing style.

Also, I brought 3 people onto the North Star team to help with marketing and strategy. My very own PayPal mafia (apart from these guys get paid in CV clout, not billions in equity).

Further readings

FT, ‘Square to acquire Afterpay for $29bn as ‘buy now, pay later’ booms’

Square, ‘Square & Afterpay’ (investor presentation, good slide design but some poor formatting, pls fix)

Ten13, ‘The secret to Square’s $29b acquisition of Afterpay’ (excellent insight into synergies between payments and BNPL)

Hey Alex, I’ve been keeping up to date with most of your posts for a while now. I appreciate how you write these articles, they’re very informative, concise & witty! Keep up the good work :)